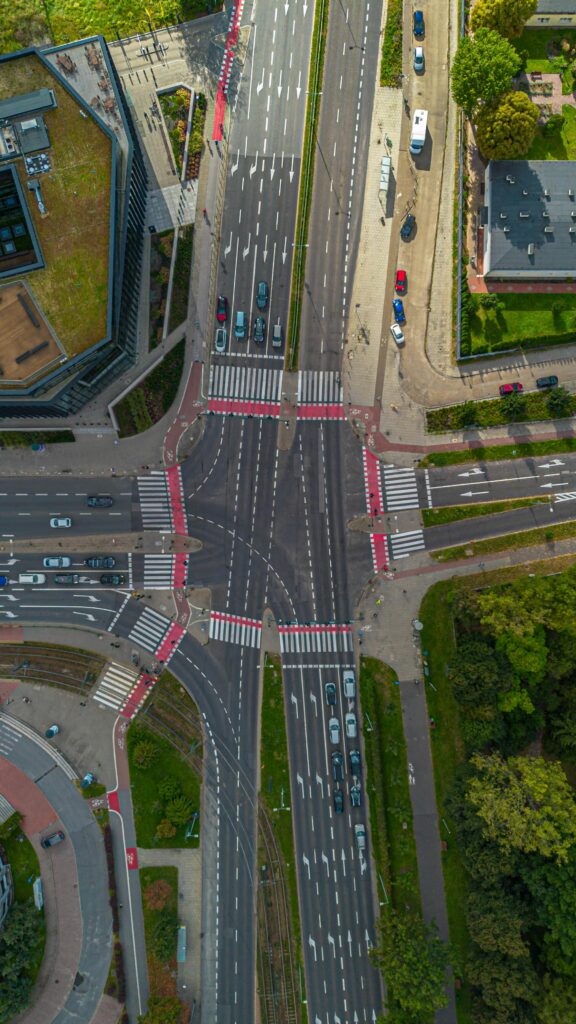

Powering the Energy Transition in Poland and Central & Eastern Europe

Our APPROACH

TPP / GreeN Energy Infrastructure

Green Energy Infrastructure is a JV investment platform between Polish TPP AM and Singaporean Impact Capital Asset Management (ICAM).

We invest in critical green energy infrastructure that delivers long-term value and supports the transition to a low-carbon, climate-resilient future. With a primary focus on Poland and the CEE region, we target attractive investment opportunities across the renewable energy value chain.

At a Glance

Region’s dynamic growth continues

Poland, after 33 years of almost uninterrupted growth of the GDP and becoming 20th largest global economy, charges through with energy and grid transformation reshaping the infrastructure for the decades ahead.

While Poland grew the fastest in Europe after 1989, to the tune of over 827% GDP growth, Slovakia and Czechia also grew their economies enormously with 784% and 550% growth, respectively.

Our Opportunity

TPP AM / Green Energy Infrastructure capitalizes on the significant energy transition opportunity in Poland and Central & Eastern Europe. The region presents compelling investment dynamics driven by ambitious renewable energy targets, substantial government support programs, and a growing gap between planned objectives and actual installed capacity.

Between 2020 and 2024, the share of renewables in Poland’s electricity generation increased from 18% to 29%, driven in large part by rapid growth in solar power. Installed solar PV capacity expanded fivefold over the period, rising from 4 GW to over 20 GW. Looking ahead, Poland is expected to invest approximately EUR 178 billion by 2030 in its energy transition, with funding directed toward grid modernisation, expansion of generation capacity, energy storage systems, and biogas infrastructure.

OUR STRATEGIES

Our investment approach leverages deep local market knowledge and operational expertise to identify and develop superior risk-adjusted returns in this dynamic sector.

We focus on essential infrastructure assets that benefit from regulatory support, long-term contracts, and stable cash generation characteristics.

Strategy A

Value-Add Energy Transition

Accelerating Growth in Renewable Energy Development

INVESTMENT FOCUS

We target high-growth opportunities in renewable energy and battery storage (BESS) across Poland and CEE, with a focus on scaling platforms and assets that directly support the region’s energy transition.

AT A GLANCE

– Maturity: Development to early-stage operations

– Investment Range: €10M – €100M

– Holding Period: 3-7 years

– Target Returns: 20%+ IRR

Strategy B

Core Assets Infrastructure

Stable Income Generation from Essential Energy Infrastructure

INVESTMENT FOCUS

Acquiring stabilized, income-generating renewable energy assets with long-term contracted cash flows and strong downside protection characteristics.

AT A GLANCE

– Maturity: Operating assets with stable cash flows

– Investment Range: €5M – €50M

– Holding Period: 5-15 years (with perpetual vehicle options)

– Target Returns: 10%+ IRR

Strategy C

Opportunistic Green Transformation

Specialized Investments for Separate Account Clients

INVESTMENT FOCUS

Targeting niche opportunities in hydro, biogas & biomethane, and emerging green transformation technologies for institutional clients seeking specialized exposure.

AT A GLANCE

– Structure: Separate managed accounts

– Investment Range: €25M – €250M per opportunity

– Holding Period: Variable (3-15 years)

– Target Returns: 15%+ IRR

“Energy transformation is not a choice but a necessity—and a great opportunity for the Polish economy.”

Donald Tusk, Polish Prime Minister

Market opportunity and outlook

Investing in essential green energy infrastructure presents a strong market opportunity—delivering stable, long-term returns while contributing to the low-carbon, climate-resilient economies. The CEE region presents exceptional growth opportunities driven by:

Regulatory Support

Comprehensive government backing through programs like Poland’s National Recovery Plan providing €16 billion in preferential financing.

STRONG MARKET DEMAND

Clear economic drivers and rising demand from both businesses and consumers continue to accelerate investments.

Technology Cost Reductions

Declining costs for renewable energy and storage technologies improve project economics.

EU Climate Targets

Ambitious decarbonization goals driving sustained investment demand across the region.

Investment Team and Expertise

Our investment team combines deep infrastructure investment experience with specialized knowledge of CEE energy markets. Led by professionals with proven track records in renewable energy development, project finance, and operational value creation.

Regional Expertise with A global network

Backed by a global network, we offer unrivaled regional expertise — combining a deep understanding of Polish and CEE regulations with long-standing partnerships across developers, utilities, and government agencies.

Investment & Capital Management

We combine disciplined investment processes, creative capital structuring, and active management to scale renewable energy in Poland and the CEE while delivering strong returns and transparent reporting.

Hands-on technical capabilities

In addition to our world-class advisors, our team conducts in-house due diligence and harnesses advanced analytics to optimize renewable-energy performance, and embeds ESG metrics to measure and amplify sustainability impact.

Managing Partner / TPP

Robert Pabierowski

Robert Pabierowski is a visionary entrepreneur and seasoned dealmaker, having led and advised on over €1 billion in energy, retail, and technology transactions during his time at EY.

As Managing Partner at TPP AM, he combines strategic insight, hands-on industry expertise, and a passion for innovation—from pioneering plug-in solar solutions at OneStep.Solar to scaling international operations at Menlo Electric—to make clean, affordable energy accessible to every European household.

Executive chairman / TPP

Grzegorz Trubilowicz

Grzegorz Trubiłowicz is a dynamic serial entrepreneur and the visionary behind TPP, he founded in 2015, where he has spearheaded nearly €5 billion in real estate transactions and financings across Europe and US.

With a career spanning tech innovation and large-scale property investment, Grzegorz brings a rare blend of entrepreneurial energy, strategic dealmaking, and operational excellence—building long-term alliances and driving TPP’s continued success at the intersection of real estate, infrastructure, and innovation.

FoUnder & CEO / ICAM

DEEPAK MAWANDIA

Deepak Mawandia brings nearly three decades of global investment and asset management experience, including his role as Chief Investment Officer for a multibillion-dollar single family office in Singapore.

As Founder and CEO of ICAM, he combines deep financial expertise with a strategic, hands-on approach—shaped by successful ventures across Asia and Europe and reinforced by his contributions to climate change mitigation through UNFCCC panels.

Stay Connected